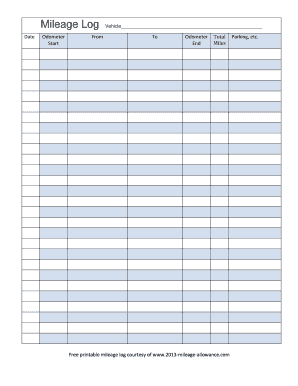

PA James S Armstrong Associates Vehicle free printable template

Show details

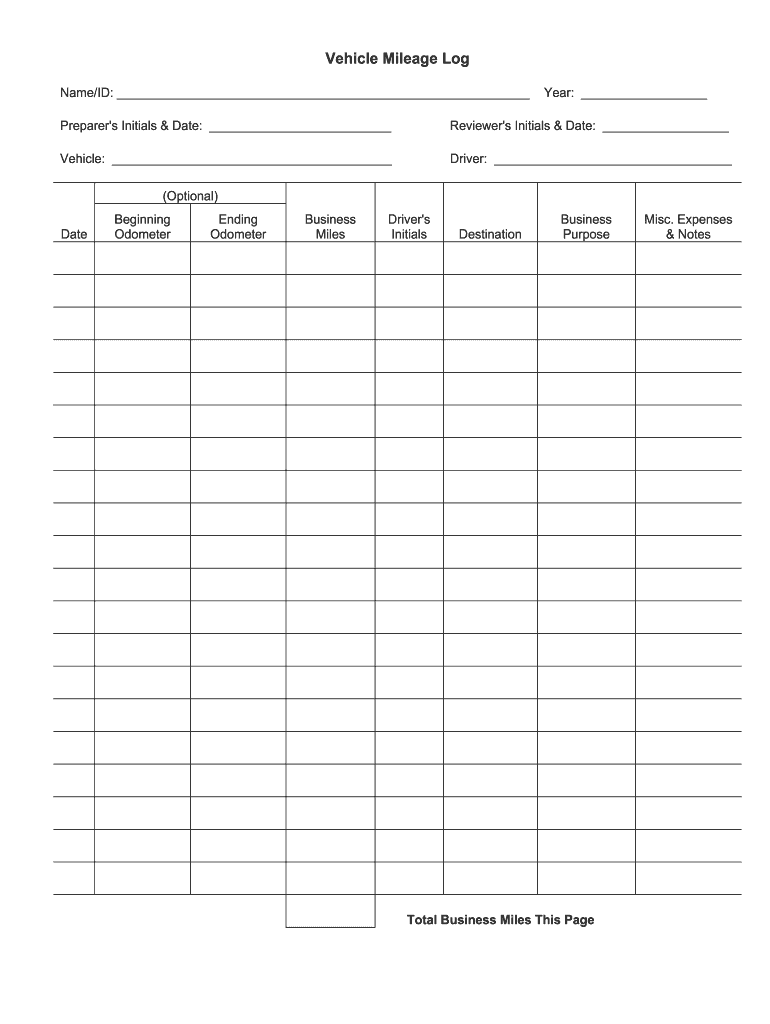

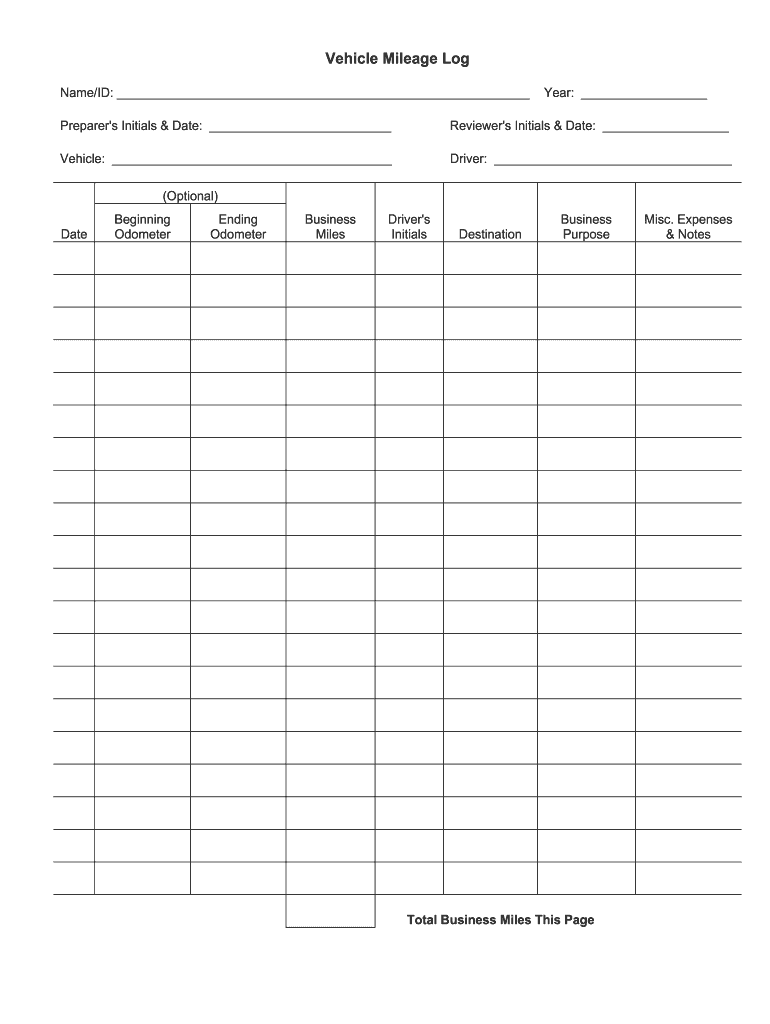

Vehicle Mileage Log Name/ID: Year: Preparer's Initials & Date: Reviewer's Initials & Date: Vehicle: Driver: (Optional) Date Beginning Odometer Ending Odometer Business Miles Driver's Initials Destination

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign vehicle mileage log form

Edit your irs approved mileage log form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs mileage log template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mileage log template online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit printable mileage log for taxes form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mileage log for taxes form

How to fill out PA James S. Armstrong Associates Vehicle Mileage

01

Gather your vehicle mileage data for the reporting period.

02

Open the PA James S. Armstrong Associates Vehicle Mileage form.

03

Fill in your vehicle's identification details, including make, model, and year.

04

Enter the starting mileage for the reporting period.

05

Record the ending mileage for the same period.

06

Break down the mileage into relevant categories such as personal, business, and other uses.

07

Add any fuel expenses incurred during the reporting period, if applicable.

08

Review your entries for accuracy and completeness.

09

Date and sign the form as required.

10

Submit the completed mileage form to the appropriate authority.

Who needs PA James S. Armstrong Associates Vehicle Mileage?

01

Employees required to log vehicle usage for business purposes.

02

Fleet managers who need to track vehicle mileage for maintenance and budgeting.

03

Accountants or financial officers responsible for reporting vehicle-related expenses.

04

Individuals seeking reimbursement for business-related travel using a personal vehicle.

Fill

irs compliant mileage log

: Try Risk Free

People Also Ask about mileage tracker template

What is proof of mileage for IRS?

If you're keeping a mileage log for IRS purposes, your log must be able to prove the amount of miles driven for each business-related trip, the date and time each trip took place, the destination for each trip, and the business-related purpose for traveling to this destination.

How do I get IRS mileage reimbursement?

The simplest method of claiming IRS mileage is through the standard mileage method. With it, you use the mileage rate set by the IRS for your business miles. Use the actual expense method to claim the expenses you've had for running your vehicle for business uses throughout the year.

What is the mileage form for taxes?

If you are a business owner or self-employed, you will record your vehicle expenses on Schedule C, Part ll, Line 9. This will be the standard mileage deduction or actual expenses you calculated.

What type of mileage log for IRS?

The IRS accepts two forms of mileage log formats: paper logs and digital logs.

How does IRS verify mileage logs?

If you're keeping a mileage log for IRS purposes, your log must be able to prove the amount of miles driven for each business-related trip, the date and time each trip took place, the destination for each trip, and the business-related purpose for traveling to this destination.

How do I make a mileage log for taxes?

The IRS specifies: At the start of each trip, record the odometer reading and list the purpose, starting location, ending location, and date of the trip. After the trip, the final odometer must be recorded and then subtracted from the initial reading to find the total mileage for the trip. 4.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mileage log pdf in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your mileage log irs and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I make changes in mileage log templates?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your mileage form template to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit mileage log for taxes template straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing irs mileage log.

What is PA James S. Armstrong Associates Vehicle Mileage?

PA James S. Armstrong Associates Vehicle Mileage refers to the record-keeping or reporting process related to the miles driven by vehicles associated with the James S. Armstrong Associates in Pennsylvania.

Who is required to file PA James S. Armstrong Associates Vehicle Mileage?

Individuals or entities that operate vehicles under the Pennsylvania James S. Armstrong Associates for business purposes are required to file the vehicle mileage.

How to fill out PA James S. Armstrong Associates Vehicle Mileage?

To fill out PA James S. Armstrong Associates Vehicle Mileage, you need to document the total miles driven for business purposes, including starting and ending odometer readings, along with the purpose of each trip.

What is the purpose of PA James S. Armstrong Associates Vehicle Mileage?

The purpose of PA James S. Armstrong Associates Vehicle Mileage is to track business-related vehicle usage for accurate reporting, tax deductions, or reimbursement processes.

What information must be reported on PA James S. Armstrong Associates Vehicle Mileage?

Information that must be reported includes the date of travel, starting and ending odometer readings, purpose of the trip, and total miles driven.

Fill out your PA James S Armstrong Associates Vehicle online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mileage Tracking Template is not the form you're looking for?Search for another form here.

Keywords relevant to simple mileage log

Related to printable mileage log

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.